Code of Ethics

Sunshine Amendment

Special Districts

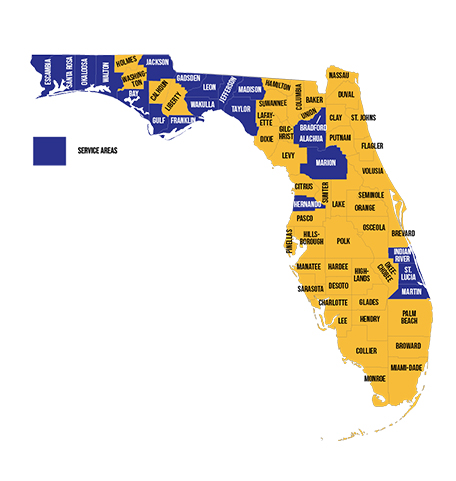

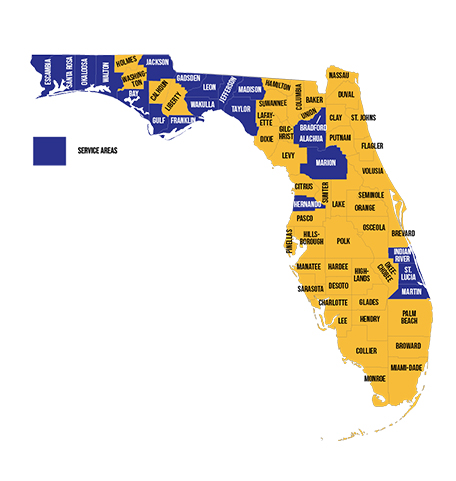

The Escambia County Housing Finance Authority (ECHFA or the Authority) serves 21 counties across Florida by offering homeownership programs to first-time homebuyers and former homeowners (Do I Qualify?). The Authority also assists developers of multi-family housing communities through the issuance of tax-exempt revenue bonds. In Escambia County, the Authority is actively involved in developing affordable single family homes through its Urban Infill Program.

The Authority is a public body enabled and operating under the laws of the State of Florida. The Authority was created in accordance with the Florida Housing Finance Authority Law, Part IV of Chapter 159, Florida Statutes, as amended, and by Ordinance No. 80-12, as amended, enacted by the Escambia County Board of County Commissioners on May 29, 1980. Escambia Commissioners are responsible for appointing ECHFA’s governing body that consists of a five-member Board. The ECHFA Board and Registered Agent, Lisa Bernau, may be reached at 700 South Palafox Street, Suite 310, Pensacola, Florida, (800) 388-1970 or by email at [email protected].

Mission

The mission of ECHFA is to help alleviate the shortage of affordable homes available to persons of moderate, middle and low income, which will provide them with safe, sanitary and decent housing; and to assist in making capital available for the financing of construction, purchase, reconstruction or rehabilitation of such homes for such persons at interest rates which they can afford.

| AMOUNT | SERIES / YEAR |

|---|---|

| Continuous Funding | Current Program |

| $6,481,473 | 2019C |

| $14,000,000 | 2019B |

| $15,000,000 | 2019A |

| $25,000,000 | 2017 Mortgage Credit Certificate |

| $16,861,686 | 2016A |

| $4,335,000 | 2014B |

| $25,000,000 | 2010 |

| $32,600,000 | 2007B |

| $39,355,000 | 2007A-1, 2007A-2 |

| $31,000,000 | 2006A |

| $33,000,000 | 2004A |

| $71,945,000 | 2002A-1, 2002A-2 |

| $96,255,000 | 2001A |

| $87,865,000 | 2000A&B |

| $93,135,000 | 1999 |

| $60,675,000 | 1998A |

| $28,350,000 | 1997C |

| $68,685,000 | 1997A&B |

| $38,355,000 | 1996A&B |

| $39,000,000 | 1995B |

| $59,000,000 | 1995A |

| $40,000,000 | 1992A |

| $47,910,000 | 1991A |

| $39,965,000 | 1990A |

| $33,865,000 | 1989C |

| $45,690,000 | 1989A&B |

| $15,000,000 | 1987 |

| $20,000,000 | 1985 |

| $22,665,000 | 1984 |

| $26,830,000 | 1982 |

| AMOUNT | PROJECT | SERIES / YEAR |

|---|---|---|

| $26,000,000 | The Moorings | 2023 |

| $24,600,000 | Sunrise Apartments | 2023 |

| $16,440,000 | College Trace Apartments | 2022 |

| $47,927,000 | Kinneret Apartments (Series A) | 2022 |

| $5,373,000 | Kinneret Apartments (Series B) | 2022 |

| $14,050,000 | Flint Gardens Apartments | 2022 |

| $8,700,000 | Orange Blossom Village Apartments | 2021 |

| $6,500,000 | Springhill Apartments | 2019 |

| $11,320,000 | Taylor Pointe Apartments | 2019 |

| $7,950,000 | Delphin Down Apartments | 2018 |

| $6,600,000 | Perrytown Apartments | 2018 |

| $14,393,280 | University of West Florida | 2015 |

| $16,525,000 | University of West Florida | 2011 |

| $11,717,000 | University of West Florida | 2010 |

| $15,000,000 | University of West Florida | 2009 |

| $9,000,000 | Johnson Lakes Apartments | 2006 |

| $18,290,000 | University of West Florida | 2005 |

| $13,455,000 | University of West Florida | 1999 |

| $15,400,000 | University of West Florida | 1998 |

| $4,650,000 | University of West Florida | 1997 |

| $4,650,000 | The Meadowrun Project | 1993 |

| $500,000 | Genesis Health Care, Inc. Project | 1988 B |

| $8,000,000 | Genesis Health Care, Inc. Project | 1988 |

| $4,060,000 | The Enclave Project | 1985 B |

| 6,070,000 | The Waterford Project | 1985 A |

| $6,000,000 | Alpine Village Project | 1985 |

| $3,050,000 | Hunters Pointe Project | 1985 |

| $2,300,000 | Sandalwood Apartment Project | 1985 |

| $2,855,000 | Colony House Project | 1984 |

| $3,000,000 | Maison Deville Project | 1984 |