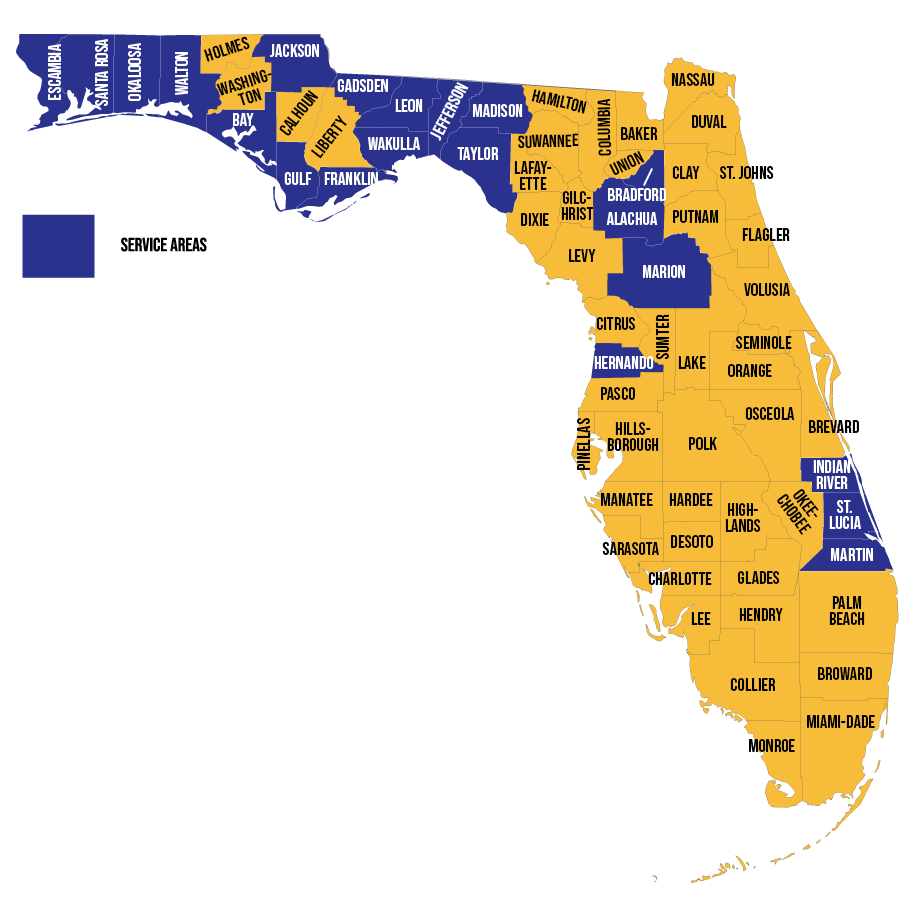

Participating Florida Counties

Alachua, Bay, Bradford, Escambia, Franklin, Gadsden, Gulf, Hernando, Indian River, Jackson, Jefferson, Leon, Madison, Marion, Martin, Okaloosa, Santa Rosa, St. Lucie, Taylor, Wakulla, Walton (or see our) Targeted Areas.

The total purchase price of a property may not exceed the Purchase Price Limits listed on the corresponding Participating County Page.